The world of investing and stock markets might seem overwhelming – complex spreadsheets, candle graphs and huge banks making billion-dollar decisions. However, investing is one of the most liberating and powerful avenues to build wealth and control financial freedom.

Indeed, while it is easy to believe that investing is a vehicle for gigantic wealth, anyone can start investing (with as little as $1).

Over years and decades, seemingly small sums can grow into huge fortunes, which is why it is worth learning more about.

The problem is that people often separate their financial, physical and mental health into separate categories. While this is understandable, these three attributes significantly influence each other.

For example, you are more likely to eat well, find time for training and invest in the right gym membership when you have your wealth game nailed down.

Conversely, you are more likely to perform in a high-pressure corporate environment if you are physically and mentally fit.

Investing can seem intimidating, especially if you’re new to it. There’s a lot of lingo to learn and seemingly endless options to choose from. But the truth is, investing is easier than you might think.

By the end of this article, you’ll have a solid foundation for making informed investment decisions and taking the first steps toward building a healthy investment portfolio.

This is how to start with investment:

What is investing?

At its core, investing is when you put your money to work in the hopes of generating a profit. The financial phrase “money should work while you sleep” comes from this.

Rather than leaving your money in a bank account (which generates minimal if any interest), you are actively hooking it to an asset that hopefully is growing in value.

Without having to do anything yourself, your wealth can grow.

Investing can take many forms, from buying shares in a business to purchasing real estate or buying government bonds. You aim to profit by buying low and selling high or generating income through interest or dividends.

Why invest your money?

There are a few key reasons why investing is a vital part of building and maintaining your financial security:

To grow your wealth…

The most compelling reason you want to invest is to increase your net worth.

While this is far from a given when you invest, if you choose your assets wisely, you will likely increase your wealth over time.

This isn’t the work of a moment, though; it can take years or even decades before your money accumulates in more significant numbers.

To beat inflation…

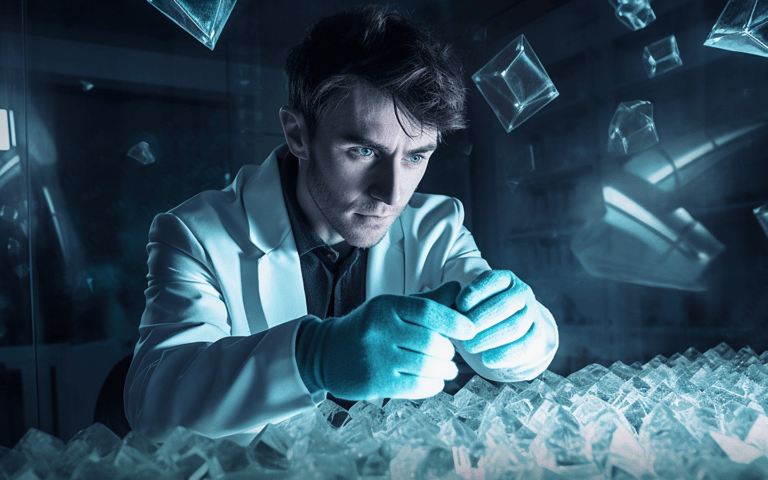

Another vital reason to invest is to beat inflation. Inflation is the byproduct of a debased currency, which many Western nations are experiencing now. If you’re not earning enough interest to cover the inflation rate, your money is effectively losing value.

The best illustration of this effect is to imagine your money is an ice cube in your hands. Inflation is like the warmth from your hand, melting it away bit by bit until there is nothing left.

However, you are essentially beating inflation and protecting your wealth when you invest in assets that rise by more than current inflation rates.

To diversify your portfolio…

Diversification is the practice of spreading your investments out over a variety of different assets to reduce risk.

Investing in a mix of stocks, bonds, and other assets can mitigate the impact of any one investment underperforming. This is especially important during times of economic downturn, when certain sectors or asset classes may struggle while others thrive.

To reach your financial goals…

Everyone wants to boost their net worth, but most believe you can only get a pay rise or start your own successful business. This couldn’t be further from the truth.

In fact, by investing your money, you can quickly accumulate wealth without facing a career change or compromising your lifestyle.

This is not to say that you will become a millionaire overnight, but it can drastically change your financial health throughout a lifetime.

How to get started with investment

Now that we’ve covered the basics of investing let’s talk about how you can get started. Here are a few steps to follow:

Set financial goals…

The first step to investing is to figure out what you’re saving for.

Do you want to retire early?

Buy a house?

Pay for your child’s education?

Figuring out your financial goals will help you determine what investments are right for you and how much risk you’re comfortable taking on.

Determine your risk tolerance…

Your risk tolerance is basically how risky you want your investments to be.

Everyone is different, so you should find out your tolerance. If you are a young person with a lifetime to earn money, then you are probably more willing to take risks than a middle-aged person saving for retirement.

You should figure out your investment time horizon to help you work your risk tolerance out.

A time horizon is a fancy term for how long you want to invest your money for (without being able to touch it).

Investing your money without first determining your time horizon is a big mistake. It gives you no barometer of success (because investments take time to reap the rewards) and makes it tempting to withdraw your money on a spur-of-the-moment impulse.

You should also reassess your risk tolerance over time to ensure you are still comfortable with your investment strategy and aren’t overstretching your finances.

Understand the financial fundamentals.

Before you can roll up your sleeves, open your wallet and start investing, you must grasp the financial fundamentals.

Although you don’t need to become a Math genius or Wall Street broker to become an investor, you should understand how it works and why you make confident financial decisions.

Here are some financial fundamentals that you should be aware of:

Compound interest

Compound interest is the hidden weapon that can build your wealth considerably over time. Yet so few people outside of financial circles understand what it is and how it works.

Bear with us because this might get technical.

Compound interest is the interest you earn on your original investment and the interest you earn on the accumulated interest from previous periods added together.

Essentially it means you are earning money twice on your investments. The longer you accumulate wealth in your investments, the greater the impact of compound interest.

This makes it far easier to build considerable wealth over time, even off a small initial investment. Compounding interest can work wonders for your bank balance if you keep adding to the pot and the asset goes up.

However, compound interest can work against you if you carry debt with high-interest rates. If you have debt, the interest you pay on it will compound over time, increasing the outstanding balance and making it harder to pay back.

This is why so many financial experts warn about the dangers of debt and how it can sneakily accumulate throughout a lifetime. Getting rid of it as quickly as possible is almost always a brilliant idea.

Overall, though, compound interest is a powerful tool in your armory. Use it wisely.

As Albert Einstein once said, “compound interest is the eighth wonder of the world”.

The range of financial asset classes

There is more than one investment asset, and you need to understand what they are.

Stocks:

When you buy a stock, you purchase a share of a company’s ownership. The value of your stock is based on the company’s performance and the overall state of the stock market.

There are different types of stocks, such as standard and preferred stocks, and they can offer different rights and dividends. Stocks can be an excellent long-term investment because they have the potential to provide capital appreciation, but they can also be volatile in the short term.

Diversifying your portfolio and considering the risks and potential rewards of investing in stocks is essential.

Bonds:

These are debt securities that are issued by companies, municipalities, and governments to raise capital.

When you buy a bond, you essentially lend money to the issuer in exchange for interest payments and the return of your principal when the bond matures.

Mutual funds:

Mutual funds are investment vehicles that pool together money from many investors and use it to buy a diversified portfolio of stocks, bonds, or other securities.

Mutual funds offer professional management and diversification at a relatively low cost.

Exchange-traded funds (ETFs):

These are like mutual funds but are traded on stock exchanges like individual stocks.

Exchange-traded funds also offer diversification and professional management, but they may have lower fees than mutual funds.

Real estate:

Investing in real estate can take many forms, such as owning rental properties, flipping houses, or purchasing commercial buildings.

Real estate can generate income through rent and appreciation, but it also involves significant upfront costs, ongoing expenses, and the potential for vacancies and repairs.

This form of investing can be useful for those with the time and resources to manage it, but it may not be suitable for everyone.

Commodities:

Commodities are physical goods such as metals, energy, and agricultural products traded on commodity markets.

Investing in commodities can be risky because their prices can be volatile, but they can also provide diversification and potentially hedge against inflation.

Cryptocurrencies:

Cryptocurrencies are digital currencies that use blockchain technology to record transactions and secure the network. They are decentralized, meaning they are not controlled by a central authority such as a government or bank.

Cryptocurrencies have gained popularity in recent years due to their potential as an alternative to traditional fiat currencies and as a means of facilitating international transactions.

However, they are highly speculative and volatile, and their value can fluctuate significantly. Investing in cryptocurrencies carries a high level of risk, and it is important to understand the risks and uncertainties before deciding whether to invest.

How to manage risk when investing

One of the most common reasons people cite for avoiding investing is the fact that it is risky.

This is certainly true (as anything that involves uncertainty is inherently risky) but it isn’t the roulette wheel that many critics make it out to be.

You should remain safe if you do your due diligence and only invest as much as you are willing to lose.

Of course, risk management should go beyond this, and become a key part of your strategy.

Why?

Because it helps minimize potential losses and protect your portfolio from scary declines.

To reduce the amount of risk you are taking on, you should aim to diversify your portfolio. By spreading your investments across different asset classes, sectors, and geographic regions, you will spread out your risk and reduce the impact of any one single investment on your overall portfolio.

You could also use stop-loss orders. You can place this order with your broker to sell a stock if it falls below a certain price. This can limit your potential losses if the stock’s price declines.

Another word that you have probably heard of if you’ve started looking into investing is leverage.

Leverage, or borrowing money to amplify your investment returns, can help boost your profits and increase your losses.

Using leverage wisely and being aware of the risks involved is vital.

Lastly, if you are uncertain about managing risk in your investments, consider seeking the advice of a financial professional.

They can guide and help you develop a risk management strategy tailored to your specific needs and goals.

Ready to invest?

It is no exaggeration to say that investing can change the course of your life. It can generate huge wealth over time, even if you only feed modest amounts of money every month.

The trick to investing is small but consistent action. You don’t have to be a risk-laden trader to make money from investing. Instead, you keep paying money into your account consistently and pick safe, high-performing assets.

When it is done right, investing is not meant to be a difficult process.

Once you have worked out what you want to invest in and why – set and forget your investment fund. This way, you will allow your assets to (hopefully) grow without being tempted to keep changing your portfolio.